Repetitive Strain Injury (RSI) is a common condition affecting millions globally from repetitive tasks or prolonged postures, leading to discomfort, pain, and potential nerve/muscle damage. Early intervention through physical therapy or shockwave therapy is key for symptom relief and preventing escalation. Insurance coverage for RSI treatment is crucial for financial protection and accessibility to quality care, including ergonomic assessments and rehab services. Proactive communication with insurers about plans, costs, and pre-authorizations ensures appropriate care without surprises, using keywords like repetitive strain injury for optimal SEO.

“Repetitive Strain Injury (RSI) is a common yet often overlooked health concern, affecting millions worldwide. Caused by repetitive tasks and poor posture, RSI can lead to severe pain and disability. This article delves into the world of RSI, highlighting its causes and symptoms. We explore the critical importance of insurance coverage for RSI treatment, as timely access to care is essential. Additionally, we guide you through navigating claims processes, offering insights on what to expect when seeking compensation for this debilitating condition.”

- Understanding Repetitive Strain Injury (RSI): Causes and Symptoms

- The Importance of Insurance Coverage for RSI Treatment

- Navigating Insurance Claims for Repetitive Strain Injury: What to Expect

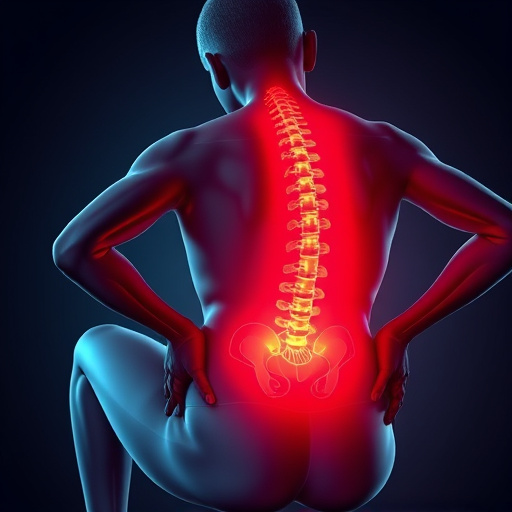

Understanding Repetitive Strain Injury (RSI): Causes and Symptoms

Repetitive Strain Injury (RSI) is a common yet often misunderstood condition that affects millions of people worldwide. It arises from repetitive tasks or sustained positions, leading to discomfort, pain, and potential long-term damage in muscles, tendons, and nerves. RSI can manifest in various body parts, with the most typical areas being the hands, wrists, arms, shoulders, back, and neck.

Causes vary widely, from repetitive motions in sports or occupations (like typing, data entry, assembly line work) to prolonged use of electronic devices without breaks. Symptoms include aching, stiffness, numbness, tingling, and weakness. Early intervention is crucial; seeking professional help through physical therapy or exploring innovative treatments like shockwave therapy can alleviate symptoms and prevent RSI from escalating. Personalized treatment plans tailored to the specific needs of each patient play a pivotal role in effective management and recovery.

The Importance of Insurance Coverage for RSI Treatment

Repetitive strain injury (RSI) is a growing concern in today’s world, especially among individuals with demanding jobs or those who engage in repetitive tasks for extended periods. This condition can lead to significant discomfort and disability if left untreated, impacting one’s ability to perform daily activities and work. Therefore, having adequate insurance coverage for RSI treatment is of utmost importance.

Insurance provides financial protection and accessibility to quality healthcare, ensuring that individuals with RSI receive the necessary treatments like physical therapy, medication, and in some cases, surgical interventions. It facilitates early intervention and management, which are crucial in preventing the progression of RSI to chronic pain states, including sciatica relief. Moreover, comprehensive insurance plans for wellness care can include long-term support, enabling individuals to manage their repetitive strain injuries effectively and maintain a good quality of life, free from the constraints of persistent discomfort or disability.

Navigating Insurance Claims for Repetitive Strain Injury: What to Expect

Navigating insurance claims for repetitive strain injury (RSI) can be a complex process, but understanding what to expect can help ease the journey. The first step involves reviewing your policy and identifying specific clauses related to occupational hazards and treatment coverage. Many policies cover preventive care and early intervention measures, such as ergonomic assessments and modifications, which are crucial in managing RSI. However, the scope of coverage for intensive rehab services, like physical therapy or specialized pain management programs, may vary widely between providers.

It’s important to communicate openly with your insurer about your treatment plan, including expected costs and duration. For back pain relief and overall pain management, some plans may require pre-authorization for certain procedures or treatments. Staying proactive in this process ensures that you receive the appropriate care without unexpected financial burdens. Keep detailed records of all communications, claims, and associated expenses to facilitate a smoother insurance claim resolution.

Repetitive strain injury (RSI) is a common yet often overlooked condition, especially in today’s digital age where many jobs involve prolonged keyboard and screen time. Understanding RSI and its causes is crucial for proactive prevention and timely treatment. Given the growing prevalence of this injury, insurance coverage for RSI treatment becomes increasingly important. By navigating the insurance claims process effectively, individuals can access necessary care and support for their recovery journey, ensuring they return to productivity without undue burden.